What is an amortization schedule?

The process of repaying a loan with interest to the lender is described in an amortization schedule. Each payment is broken down in terms of how much is applied to the principal and how much is interest. The distribution between principal and interest varies over time so the amortization schedule specifically illustrates the changes.

Understanding an amortization schedule

The easiest way to understand an amortization schedule is through an example using a mortgage. Let's say you want to purchase a $100,000 home so the bank agrees to provide with a loan at a fixed interest rate of 5% for 15 years. To better understand how you will pay off the loan, you create an amortization schedule.

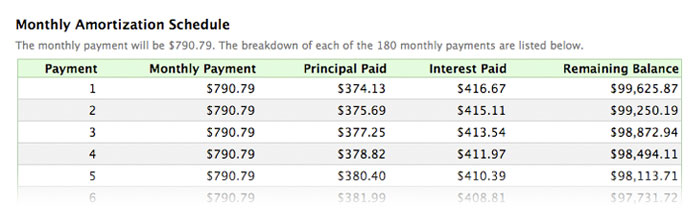

Since it is a 15 year loan, the amortization schedule shows you will have to make 180 payments (15 * 12 = 180). If there was no interest rate, determining your monthly payment be simple: $100,000 divided by 180 payments = $555.56 per month. But with a 5% interest rate, the monthly payment turns out to be $790.79 (determining the monthly payment requires a rather complex math formula).

Next you see that a portion of each payment is interest while the rest goes towards the loan's remaining balance. The distribution of these two amounts in each payment varies with the interest portion declining with each payment. Understanding how the interest is determined for each payment is not a tricky as it seems.

The 5% interest rate is an annual interest rate. To determine the monthly interest rate, it must be divided by 12. Then the monthly interest rate is multiplied by the remaining balance to determine how much interest needs to be paid. Here is the process for determining the first month's interest and portion that goes toward the loan's remaining balance.

Step 1. 5% annual interest rate / 12 = 0.42% monthly interest rate

Step 2. 0.42% * $100,000 = $416.67

Step 3. $790.79 - $416.67 = $374.13

This process is repeated for each payment until the loan is paid back in full. Since the remaining balance of the loan is decreasing, the amount of interest declines as well allowing the amount to pay off the loan to rise each month.

At the end of this loan, you will have not only paid back the $100,000, but also paid $42,342.85 in interest. To see this for yourself, return to the top of this page and press the Create button to see a complete amortization schedule.